Posts Tagged ‘Euro’

Tuesday, March 26th, 2013

So the Cyprus crises is “solved,” for values of “solved” that means “everyone but bankers and Eurocrats get screwed.”

“The message that stakeholders of all stripes can be coerced into helping a cash-strapped nation may make investors more skittish they’ll be targeted if Slovenia, Italy, Spain or even Greece again is next in line to need help. The risk is that bank runs and bond market selloffs become more likely the moment a country applies for a new rescue.” A funny definition of the word “helping.” Like “helping” a mugger holding a gun to your head.

And just in case you think I’m exagerating: Cyprus is seizing money from people at the border.

“Why would anybody keep more than €100,000 in a Greek or a Spanish or an Italian bank?…In short, the Dijsselbloem plan was a plan to bankrupt southern European banks and make southern European euros worth less than northern European euros. In case you were wondering, this is the farce stage of the euro tragedy.”

UKIP Leader: Get your money out of Spain while you have the chance:

“If we are seeing the limits of German willingness to support eurozone bailouts when the numbers don’t matter, what will happen when the numbers do matter very much?”

Legal Insurrection has a few more lessons.

The European cradle-to-grave welfare state is unsustainable. It’s only a matter of how many trillions will be destroyed before the world is willing to face that fact.

Tags:Budget, Cyprus, Economics, Euro, European Debt Crisis, Welfare State

Posted in Budget, Economics, Welfare State | No Comments »

Thursday, March 21st, 2013

Cyprus crisis is a miniature version of the Greek crisis, and the Greek crisis is a miniature version of Europe’s crisis. The scale and details differ, but the underlying problem is mind-numbingly familiar: People spending too much of other people’s money with too little accountability. Cyprus bank bailouts are unsustainable in the same way that Greek government bailouts are unsustainable in the same way that the European cradle-to-grave welfare state is unsustainable.

How could it have been avoided? The same way any of the multitudes of financial crises that have rocked Europe in last several years could have been avoided: Don’t spend money you don’t have. That solution is both blindingly obvious and completely unacceptable to the Eurocratic elite (as well as our own liberal ruling class). After all, the bloated welfare state is where they get theirs. Nothing can be allowed to come between the permanent ruling class and their perks. Nothing.

Some current Cyprus news:

Four days left until the next end of the world.

Background on the Cyprus crisis.

Once Greece hit the skids in 2010, it was inevitable that Cyprus would follow. Already by 2011 the government was effectively prevented from selling bonds by a junk credit rating. It resorted to a €2.5 billion ($3.2 billion) loan from the Russian government, due in 2016. The killer, though, was the pact reached in October 2011 to reduce the value of Greek government bonds by 70 percent. That produced a loss to the Cyprus banks of more than €4 billion—the same in proportion to the economy’s size as a $4 trillion loss in the U.S. President Demetris Christofias, seemingly not realizing the severity of the blow, agreed to the haircut without seeking offsetting aid for Cypriot banks. He eventually sought a bailout, but, befitting a left-wing politician who earned a doctorate in history in the Soviet Union, dragged his heels on cutting government spending while inveighing against the “troika” of the European Union, the European Central Bank, and the International Monetary Fund. Losses mounted.

Russia to Cyprus: Die in a fire.

Explaining the Cyprus crisis like you’re an idiot.

It’s Crazy Stan’s Discount State Assets Stand! Everything must go!

Tags:Budget, Cyprus, Economics, Euro, Europe, European Debt Crisis, Welfare State

Posted in Budget, Economics, Welfare State | No Comments »

Tuesday, March 19th, 2013

Update: REJECTED!

Imagine a basketball being swatted back into Angela Merkel’s face…

A few updates on yesterday’s Cyprus bank deposit seizure story.

Supposedly the votes aren’t there to ratify the money grab. Which may mean that Angela Merkel and the EU will just keep twisting until the “proper” decision is arrived at.

“A one-time, ad hoc seizure of money isn’t a tax. It is confiscation. Or we can use a plainer word for it: theft.”

“The decision to expropriate Cypriot savers—even the poorest—was imposed by Germany, Holland, Finland, Austria, and Slovakia, whose only care at this stage is to assuage bail-out fatigue at home and avoid their own political crises.”

The Cyprus crisis as a pick-your-own-path adventure. That’s almost as retro as fiscal restraint and balanced budgets.

The New York Times says not to worry about Cyprus. OK, now I’m really worried.

The EU creditor states have at a single stroke violated the principle that insured EU bank deposits of up $100,000 will be guaranteed come what may, and in doing so they have more or less thrown Portugal under a bus.

They have demonstrated that the rhetoric of EMU solidarity is just hot air, that they will not force their own taxpayers to share a single cent of clean-up costs for the great joint venture of monetary union – in which northern banks, insurers, pension funds, and indeed governments, were complicit.

Their refusal to pay is entirely understandable in one sense – and if I were a German taxpayer, I would not care to swallow these losses either – but then the leaders of these creditor countries can hardly expect the world to believe that they will in fact do whatever it takes to hold EMU together. Quite obviously, they will not.

The sooner this is made clear, the better. The sooner they take the proper course of withdrawing from EMU and organise the break-up the euro in the least disruptive way, the sooner Europe can recover.

Tags:Budget, Cyprus, Euro, European Debt Crisis

Posted in Budget, Economics, Welfare State | No Comments »

Monday, March 18th, 2013

Chances are pretty low that you haven’t heard that the EU has decided to seize portions of people’s bank accounts in Cyprus as a condition of a bank bailout:

When Cyprus’s banks reopen on Tuesday morning, every depositor will have some of his or her money seized. Accounts under 100,000 euros will have 6.75% of the funds seized. Accounts over 100,000 euros will have 9.9% seized. And then the Eurozone’s emergency lending facility and the International Monetary Fund will inject 10 billion euros into the banks to allow them to keep operating.

It’s hard to express in words just how bad an idea this is. Europe has truly crossed the Rubicon.

“The establishment of the principle that a government can, and at times of economic strain must, help itself to your savings, and that this is a legitimate tool of statecraft, ought to provoke riots.”

I’ll go further: riots are not enough.

If I were one of the people having my wealth confiscated, the proper response to such actions would be join an angry mob hanging the still-twitching bodies of the people who proposed and passed such a measure over the nearest lightpost.

Think it can’t happen here? Remember, liberals have already floated the idea of seizing your 401K.

The Eurocrats in Brussels have already decided that they would prefer to seize people savings rather than let the Euro fail, or admit that the European cradle-to-grave welfare state is unsustainable. “The dream of political union matters more to Europe’s governing caste than the well-being of the people they represent.”

I didn’t post anything yesterday because I was trying to figure out how much money I should put into gold and silver to get ahead of the European bank runs I half anticipated. Indeed, in this case such bank runs would etirely rational But they haven’t started outside Cyprus itself.

Yet.

More Cyprus news here.

Tags:Budget, Cyprus, Democrats, EU, Euro, European Debt Crisis

Posted in Budget, Democrats, Economics, Welfare State | 1 Comment »

Tuesday, July 17th, 2012

In order to divert attention away from the economic, moral, and political bankruptcy of Europe’s cradle-to-grave welfare state, some liberals, relying on figures from the Out of Our Ass Institute of Statistics, are tying to claim that Greece’s excessive spending comes from a “bloated defense budget.”

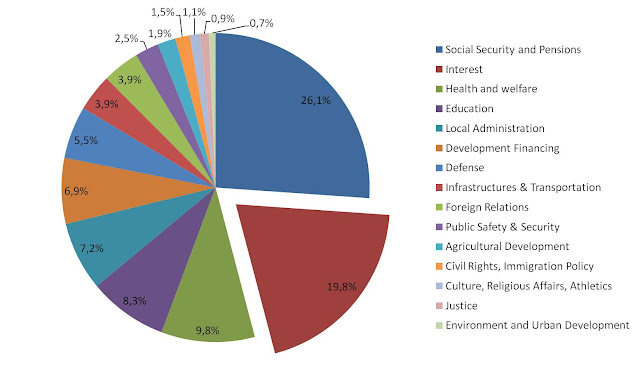

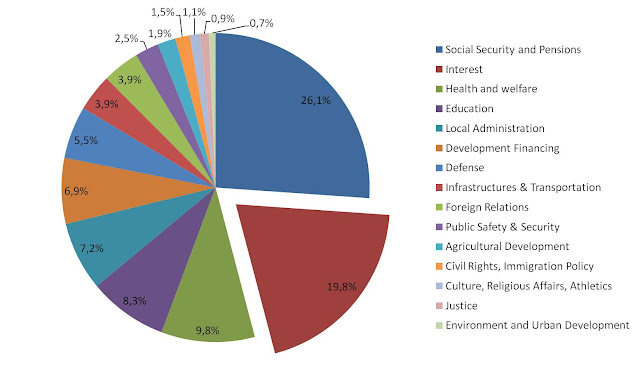

Try again. Greece only spends 5.5% of it’s budget on defense:

Either Europe (and the United States) must reform their runaway, bloated welfare states, or their welfare states will bankrupt their nations.

Tags:Euro, European Debt Crisis, Greece, Welfare State

Posted in Budget, Economics, Welfare State | 2 Comments »

Sunday, June 17th, 2012

Feeling less suicidal than usual, Greek voters have opted for the conservative (for Greece) New Democracy party in parliamentary elections, beating out the radical-left Syriza, which insisted Europe keep shoveling money into the black hole that is the Greek budget, but rejected even the fake austerity the Eurocrats demanded. New Democracy leader Antonis Samaras has his work cut out for him, convincing the Eurocrats that yes, this time, they really are implementing austerity. This time for sure!

Look for this to help forestall the inevitable “grexit” for, oh, maybe three months. Which is when I bet Greece will find out it can’t pay it’s bills again after the latest infusion of cash, the money Europe kicked in will have strangely disappeared without seeming to have been spent on any fundamental government services, and insiders will have managed to transfer another few months of funds into their out-of-country banks accounts in advance of the next crisis…

Tags:2012 Election, Antonis Samaras, Budget, Elections, Euro, Europe, European Debt Crisis, Foreign Policy, Greece, grexit, Welfare State

Posted in Budget, Elections, Foreign Policy, Welfare State | No Comments »

Friday, June 15th, 2012

So Greeks head off to the polls this weekend to (theoretically) choose whether to muddle along with a “right” (for Greece) government that will actually attempt to carry out something vaguely resembling austerity, or for Alexis Tsipras’ far-left Syriza party, who intends to re-enact Clevon Little’s scene from Blazing Saddles: “Drop the austerity demands, or I’ll drop out of the Euro and refuse to let Germany bail us out anymore!” “Do what he says, do what he says, that Greek’s crazy!” It’s anybody’s guess whether Greece will opt to keep the farce going for another few months, or finally set the whole house of cards tumbling down.

My guess is that there are still enough insiders who can benefits from dumping PIIGS bonds onto various sets of European taxpayers, so I expect that, one way or another, the Eurocrats will find a way to keep the charade up for another two or three months.

In light of that, here’s a roundup of Euro debt news:

Forget grexit. The new hotness is Spexit and Spanic.

Which is why the EU just gave Spain a €100 billion life preserver. That should be good for, what, three months?

Which is why Fitch and Moody’s downgraded Spanish banks and debt.

Which is why Spanish borrowing costs have soared.

And Spain’s deal? Ireland wants some of that. And given the way Irish taxpayers were made to eat Anglo Irish Bank’s debts, I can’t say that I blame them.

And did I mention that Italy’s debt market might collapse?

Which explains why Italy is making noises about actual budget cuts and selling off state owned assets. Naturally, Italian unions are threaten to strike.

“By any objective criteria the Euro has failed, and in fact there is a looming, impending disaster.”

Tsipras has all but flipped Merkel off.

And Merkel fliped him off back.

Europe prepares for an influx of Greek refugees. And by “prepares,” I mean “prepares to keep them out.”

France and Spain want to dig faster.

Obama is boned because Europe is boned.

How the Euro will end: “Greece will simply run out of cash. Then Spain’s real-estate bubble will ruin an economy that really matters.”

Still not completely depressed about Europe’s prospects for escaping the trap created by their bankrupt cradle-to-grave welfare states? Well then, here’s some Mark Steyn to cruelly stomp on those last flickering embers of hope.

Have a happy weekend!

Tags:Alexis Tsipras, Angela Merkel, Budget, Euro, Europe, European Debt Crisis, Germany, Greece, Ireland, Mark Steyn, PIIGS, Spain, Syriza, Welfare State

Posted in Budget, Economics, Foreign Policy, Welfare State | 2 Comments »

Friday, June 1st, 2012

How about a nice slice of EuroDoom to ease you into the weekend?

With all the post-primary news, the European Debt Crises news has been chugging along for a while now. let’s look at some, shall we?

Heh. “The Euro cannot be destroyed by any craft that we here possess. It was made in the fires of Frankfurt. Only there can it be unmade. It must be taken deep into the heart of the European Central Bank, and cast back into the fiery chasm from whence it came!”

If the Leftists win the next round of voting in Greece, they promise to cancel the EU-sponsored bail-out and re-nationalize banks and companies. Way to calm the markets, dude! Not to mention reenacting Clevon Little’s famous scene from Blazing Saddles. “Experience is a dear teacher, but fools will learn from no other.”

“It is no longer a question of if, but how, Greece will leave the euro.”

The money flight from Greek banks continues.

And there’s this: “I can see only one mechanism that could force a collapse of the eurozone: a generalised bank run in several countries.”

In the showdown between Greece and the IMF, both sides deserve to lose.

NEIN! “Almost 80% of Germans reject eurobonds and 60% are against Greece remaining in the euro.”

Germany and Greece play chicken over the euro. That’s like a Mercedes playing chicken with a [ERROR: NO GREEK AUTOMAKER FOUND. ANALOGY ABORTED.]

Ireland votes yes on the Fiscal treaty, and then turns around with an implied “Now fork it over, Otto.”

Why Germany is great and Spain is totally screwed.

It’s a winner-take-all world. Countries that do well have to do a few things extremely well. Germany makes the world’s best machine tools, some of the best heavy engineering equipment, not to mention autos. German manufacturing dominates innumerable key niches. The Spanish don’t do anything well. They haven’t done anything well since the Spanish Empire outsourced its manufacturing to Flanders in the 16th century.

And Spain is really screwed.

Which is why the Germans seem inclined to let them have more rope.

Though at least one source says reports of Spanish bank runs are exaggerated.

But even Germans are getting nervous. Also this:

As a journalist told me yesterday, he worries whether the money in his pocket will be worth anything a year from now. Others worry about Germany’s increasingly negative image among recession-hit southern and eastern Europeans. Americans will understand this feeling well: you pay and pay to help others, only to have them turn on you in hatred and wrath, accusing you of horrible hidden motives and denouncing your selfishness.

Eurobills instead of Eurobonds?

Tags:Euro, Europe, European Debt Crisis, Germany, Greece, Ireland, Spain, Welfare State

Posted in Budget, Economics, Elections, Foreign Policy, Waste and Fraud, Welfare State | 1 Comment »

Thursday, May 24th, 2012

Are the Greeks already printing Drachmas? So says a completely unverified tweet from a random Twitter user. Really, what better source could you possibly ask for?

The Internet is alive with buzz on Greece exiting the Euro (see #grexit for a sip from the firehose). Sadly, there seems to be no buzz at all on reigning in the cradle-to-grave European welfare state that caused the crises in the first place.

More Grext/European debt crises news:

The Fraud of Austerity.

The European debt crises as the world’s longest root canal with the world’s dullest dental drill.

How lovely: diseases unknown to Europe are making a comeback thanks to the Greek government’s colossal mismanagement.

Problem: Greece’s government will seize their citizens’ Euros to forcibly convert them into Drachmas. Solution: Withdraw your cash in Euros. Problem: Burgler’s have figured this out too.

Spain’s Prime Minster: Screw the long term Euro plans, I need the European Central Bank’s sweet low rates right now.

Maybe because his government just pumped €9 billion into failing banks.

Who’s most exposed to the grexit? Italian and Spanish insurers.

There’s no conflict between real austerity and pro-growth polices. Too bad no one in Europe is willing to try them.

Wait, The Guardian actually printed an editorial by John Bolton? (“And the moon became as blood…”) It’s a good one, too:

“Growth” to social democrats means growth in government’s size and reach, not growth in the real economy. This approach directly contributed to our current predicament; and more of the same will only exacerbate it.

Tags:Euro, Europe, European Central Bank, European Debt Crisis, Greece, grexit, Italy, John Bolton, Spain, Welfare State

Posted in Budget, Economics, Foreign Policy, Waste and Fraud, Welfare State | No Comments »

Monday, May 21st, 2012

Though markets have calmed a bit, the desperate search for a lever that will actually steer Europe away from the looming wall of a EuroCrash continues. Meanwhile, certain repeating motifs are detected:

“Now that times are bad, the single currency has turned into an unbridled doomsday machine. Merkel continues to insist that she’ll do whatever it takes to save Europe’s “destiny”. The continued insistence on fiscal austerity and debt repayment tells a different story. Is Germany really prepared to bankroll a wider monetary union by putting its money where its mouth is, or is the game finally up?”

Boris Johnson also calls the Euro a Doomsday Machine:

Europe now has the lowest growth of any region in the world. We have already wasted years in trying to control this sickness in the euro, and we are saving the cancer and killing the patient. We have blighted countless lives and lost countless jobs by kidding ourselves that the answer to the crisis might be “more Europe”. And all for what? To salvage the prestige of the European Project, and to spare the egos of those who were wrong and muddle-headed enough to campaign for the euro.

Johnson is right about the cancer, but slightly wrong about the cause: The European cradle-to-grave welfare state is the cancer; the Euro just made it slightly more malignant.

But with two separate commentator’s calling the Euro a Doomsday Machine, I feel a new meme coming on:

Not to mention much better chances of being linked by Jonah Goldberg and James Lileks…

Europe is awakening from its Utopian dream.

Greece’s invisible bank run.

Greece is happy to stay in the Euro…as long as other countries are footing the bill. They want more subsidies and an end to even the #fakeausterity. Not only do they want to continue to dig their deficit spending grave, they insist on digging it as fast as possible. How to get Germany to agree to continue footing the bill is the one flaw in their otherwise cunning plan…

Why the Blue State model doesn’t work: Cheap money doesn’t mean welfare states balance their budgets, it just means they spend that much more:

Greece, Spain, Ireland, Portugal and Italy (and California). In each case, the promise of more bailouts and a steady flow of cheap money only produced more reckless behavior, excessive levels of government spending and record levels of debt.

Johan Norberg, a senior fellow at the Cato Institute, summarizes the results: “From 1997 to 2007, government expenditures increased by around 6 percent annually in Spain, Portugal and Greece, while population remained mostly stable. Spending increased by 4 percent a year in Italy — even while the economy shrank.”

Consequently, “Between 2000 and 2010, Portugal increased its public debt as a share of GDP from 49 percent to 93 percent, France from 57 percent to 82 percent, Italy from 109 percent to 118 percent, and Greece from 103 percent to 145 percent,” reports Norberg.

Greece and California are headed down the same path to disaster, and for the same reason.

In addition to budget deficits, the EU suffers from a deficit of democracy:

The European crisis is as much a crisis of politics as economics. The current paralysis of the Greek political system demonstrates the point very clearly. EU policy has actively contributed to this crisis by effectively sealing off discussion of the political problems thrown up by austerity.

Budgetary policy is at the core of traditional democratic politics in Europe but the management of the euro zone is increasingly being effected not through democratic institutions but via a centralised and depoliticised form of technocratic fiat. The “stability” narrative has triumphed over the need for legitimacy as the crisis in Europe has deepened.

Ivan Krastev, the eminent political scientist, argues that we have now arrived at a point where national governments have politics but are no longer in control of policy, including budgetary policy, which is moving via the fiscal treaty and other measures to the EU level.

On the other side of this divide the European Union has policies but no politics, since decisions are increasingly being made by technocratic managers rather than directly elected representatives of the European public. The euro zone crisis has thus amplified an existing problem – the absence of both a European citizenry and a transparent European level political process.

A long meditation on what a Greek exit would mean involving Frankenstein, Old Maid, and David Brin.

The EU sends inspectors to find out why Spain’s deficits are so high. Offhand I would say the solution to the mystery might be “because they’re spending more money than they’re taking in.” Obviously such thinking will never get you anywhere in the EU civil service…

Tags:California, Doomsday Machine, Euro, Europe, European Debt Crisis, Greece, pics, PIIGS, Spain, Star Trek

Posted in Budget, Economics, Foreign Policy, Waste and Fraud, Welfare State | 1 Comment »