Posts Tagged ‘pension crisis’

Thursday, October 1st, 2015

Ah, that October chill…is not evident yet here in Austin. It’s supposed to hit 94° today.

Time for another Texas vs. California roundup:

The joys of working in Los Angeles: a $30,000 tax bill on $500 worth of freelance income.

California nears passage of another trial lawyer full employment act.

Texas had five of the ten fastest growing metropolitan areas in 2014. Austin isn’t on this list, but Midland and San Angelo are numbers one and two. (San Jose, California’s lone entry, checks in at eight.)

72% of Californians polled thinks the state has a pension crisis. Too bad this thinking doesn’t seem to influence their voting patterns yet… (Hat tip: Pension Tsunami.)

And yet a new bill would exempt some new hires from paying their fair share of pension costs. (Hat tip: Pension Tsunami.)

New pension accounting rules are about to show that a lot more California municipalities are insolvent.

“Instead of building freeways, expanding ports, restoring bridges and aqueducts, and constructing dams, desalination plants, and power stations, California’s taxpayers are pouring tens of billions each year into public sector pension funds.” (Hat tip: Pension Tsunami.)

Stockton’s bankruptcy didn’t solve it’s pension crisis.

Texas had a net gain of 103,465 people in 2014, the largest number of which came from California.

San Francisco wants to keep housing affordable…by restricting supply. Looks like somebody failed Economics 101…

Pension reform initiative to be refiled?

Unions are trying to undo San Diego’s voter-approved pension reforms. Because of course they are.

“Texas is like Australia with the handbrake off. There is no individual income tax and no corporate income tax, which explains the state’s rapid economic and population growth. A recent downturn has sparked some concern, however. Apparently Texas will only create another 150,000 jobs during 2015 – about the same number as Australia, from a population only a few million larger. In a good year, that number of jobs is easily generated by a single Texan city.” Also: IowaHawk’s illegal human organ trafficking!

Texas ranks 13th in budget transparency. California? Dead last.

Even some California Democrats balked at increasing the state’s already high gas prices.

As part of the bankruptcy of northwest supermarket chain Haggen (which bought a bunch of Albertson’s stores just six months ago), they’ll be closing all their California stores. And if you guessed that Haggen is unionized, you would be correct.

Jerry Brown revives the state’s redevelopment agency…and its potential for eminent domain abuse.

Reminder: Texas is enormous.

A scourge spreads out upon California. Crack gangs? Illegal aliens? Try “short term rentals.”

Historical note: 105 years ago today, three union guys bombed the Los Angeles Times, killing 21 people.

Tags:Albertson's, Australia, California, Crime, Democrats, Haggen, Jerry Brown, Los Angeles, Midland, pension crisis, San Angelo, San Jose, Stockton, Texas, unions, Welfare State

Posted in Crime, Democrats, Regulation, Uncategorized, unions, Waste and Fraud, Welfare State | No Comments »

Tuesday, August 25th, 2015

California has long had a tenuous grasp of what the rest of us regard as consensus reality. But two new pieces of legislation suggest they’ve gone off the deep end into full Victimhood Identity Politics land:

First, they decided that police shootings wouldn’t be subject to the grand jury process, because what’s a little things like two centuries of due process and the fifth amendment to the Constitution when there are policemen to be railroaded to satisfy black protesters?

They also decided to purge the words “illegal alien” from state statutes, because what’s mere law when there’s political correctness to be pandered to?

Of course, that’s not all that’s new on the Texas vs. California front:

“California taxpayers paid out big bucks to state workers in 2014. How much? More than the Gross Domestic Product of 100 countries, according to new data published by the State Controller’s office. In 2014, more than 650,000 state employees earned a total of $32 billion in wages and benefits.” It gets better: “Nine hundred sixty-nine state employees earned more than the President of the United States.” Added irony:

The lowest paid average workers represented agencies focused on the environment, women and people with disabilities. According to the state’s 2014 payroll data, the average salary for the 11 state employees at the California Commission on Disability Access was just $15,213 per year, slightly more than the $14,494 average salary paid to the four employees at the Commission on the Status of Women.

There is no California. Only Zuul…

Texas unemployment rate: 4.2%. California unemployment rate: 6.2%. (Hat tip: WILLism’s Twitter feed.)

Los Angeles’ new minimum wage has wrecked hotel employment. Or maybe just non-illegal alien employment… (Hat tip: Moe Lane.)

Why Public Services in California Decline Even As Revenues Rise. “Until California’s leaders address the three elephants – retirement, healthcare and corrections costs — that are crowding out public services and causing unproductive tax and fee increases, citizens will continue to suffer and inequality will continue to grow.” (Hat tip: Pension Tsunami.)

Chuck Devore on what makes Texas friendly to business: less red tape and lower taxes.

Voters to San Jose City Council: We want pension reform! San Jose City Council to voters: Get stuffed! (Hat tip: Pension Tsunami.)

TV’s CHiPS never seemed to be involved in ethics scandals the way the current administration is, including no-bid contracts to European companies. (Bonus: it’s also suitable for Dwight’s Art Acevedo watch.)

California’s “Green Jobs Initiative” spent $297 million to create 1,700 jobs.

More on the same theme, and Tom Steyer wasting $29.6 million of his own money pushing it, from City Journal.

California’s SFX: from billion dollar company to bankruptcy.

Tags:Border Controls, Budget, California, Chuck DeVore, Crime, Democrats, environmentalism, fraud, minimum wage, pension crisis, Political Correctness, San Jose, Social Justice Warriors, Texas, Tom Steyer, unions, waste, Welfare State

Posted in Border Control, Budget, Crime, Democrats, Social Justice Warriors, Texas, unions, Waste and Fraud, Welfare State | 5 Comments »

Thursday, April 30th, 2015

Time for another Texas vs. California roundup, albeit a somewhat smallish one:

UC-Berkley misused nearly $2 million in National Science Foundation funds on staff salaries, travel expenses, and booze.

How California teacher’s unions indoctrinate children with left-wing propaganda.

Thanks to overly generous pension rules, Vallejo may be headed for a second bankruptcy. (Hat tip: Pension Tsunami.)

Eureka, California will be laying off police to pay for pensions. (Hat tip: Pension Tsunami.)

Farmer Brothers coffee roasters is moving from California to Denton. (Previously.)

Jerry Brown has ordered a radical cut in California’s greenhouse gases. Evidently he wants all of California’s manufacturing to move out of state…

Though Texas does a vastly better job than California managing statewide finances, local debt is close to California’s:

Among the top ten most populous states in the nation, local debt in the Lone Star State was the second highest overall, at $219.7 billion. Only California’s local governments had amassed more, at $269.2 billion.

On a per capita basis, local debt in Texas ranked as the second highest ($8,431 owed per person), with only New York in tougher shape ($10,204 owed per person). The average local debt burden among all mega-states was $5,956 owed per person.

So California may use drought bond money to pay for water not for people, but for the Delta Smelt?

West Coast truckers strike over alleged millions in wage theft. You may have gathered that I’m not exactly a pro-union guy, but from what a relative has told me about the trucking industry, I wouldn’t be at all surprised if the strikers were fully justified in this instance…

Tags:California, debt, Democrats, environmentalism, Global Warming, Jerry Brown, pension crisis, Texas, unions

Posted in Democrats, Global Warming, Texas, unions, Welfare State | No Comments »

Friday, April 24th, 2015

Time for another Texas vs. California roundup:

The Manhattan Institute has a new report out discussing how California’s pension spending is starting to crowd out essential services. (Hat tip: Pension Tsunami.)

Austin is the number one city in the country for technology job creation.

Texas unemployment is down to 4.2%.

That’s the lowest unemployment rate since March of 2007.

Marin County Grand Jury:

Unfunded pension liabilities are a concern for county and city governments throughout California. Reviewing this problem in Marin County, the Grand Jury examined four public employers that participate in the Marin County Employees’ Retirement Association (MCERA): County of Marin, City of San Rafael, Novato Fire Protection District, and the Southern Marin Fire Protection District, hereafter collectively referred to as “Employer(s)”

The Grand Jury interviewed representatives of the County of Marin, sponsors of MCERA administered retirement plans, representatives of MCERA, and members of the various Employer governing boards and staff. It also consulted with actuaries, various citizen groups, and the Grand Jury’s independent court-appointed lawyers.

In so doing, the Grand Jury found that those Employers granted no less than thirty-eight pension enhancements from 2001- 2006, each of which appears to have violated disclosure requirements and fiscal responsibility requirements of the California Government Code.

(Hat tip: Pension Tsunami.)

The Marin Country lawyer: Nothing to see in this Grand Jury Report! Critics: Hey, aren’t you pulling down a cool $434,000 by “triple dipping” the existing system? (Ditto.)

Why does the University of California system have to hike tuition 28%? Simple: Pensions.

As with other areas of state and local budgets, a big factor is pension costs, which for UC have grown from $44 million in 2009-10 to $957 million in 2014-15. And the number of employees making more than $200,000 almost doubled from 2007-13, from 3,018 to 5,933.

While total UC employees rose 11 percent from October 2007 to October 2014, the group labeled “Senior Management Group and Management and Senior Personnel” jumped 32 percent.

(Hat tip: Pension Tsunami.)

Los Angeles Teacher’s Union gets a 10% pay hike over two years.

Like everything else associated with ObamaCare, covered California is screwed up.

BART wants a tax increase. This is my shocked face. (Hat tip: Pension Tsunami.)

And by my count, there are 157 BART employees who make more than $200,000 a year in salary and benefits…

California state senate committee votes to raise California’s minimum wage to $13 by 2017. If I were Gov. Greg Abbott, I’d be ready to start sending Texas relocation information packets to large California employers the minute this gets signed into law.

California-based Frederick’s of Hollywood files for bankruptcy. The retail lingerie business just isn’t what it used to be…

Torrence, California newspaper wins Pulitzer Prize for reporting on local school district corruption.

Priorities: Carson, California approves $1.7 billion for an NFL stadium even though they don’t have an NFL team to put in it.

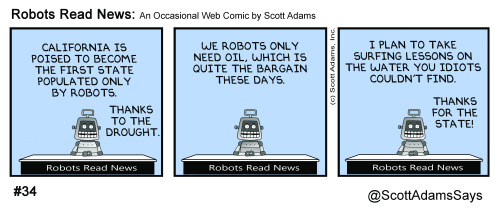

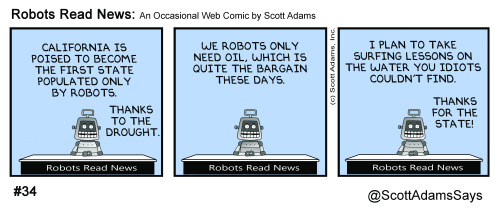

Dilbert’s Scott Adams weighs in on California’s drought:

Tags:Austin, California, Democrats, drought, Los Angeles, Los Angeles Unified School District, Marin County, ObamaCare, pension crisis, Texas, unemployment, unions, University of California, waste, Welfare State

Posted in Austin, Budget, Democrats, ObamaCare, unions, Waste and Fraud, Welfare State | No Comments »

Sunday, April 5th, 2015

National Journal has a piece up by moderate lefty John B. Judis on all the problems plaguing Chicago.

Perhaps more than any other major city in America, Chicago is facing a truly grave set of problems—problems that are essentially more extreme versions of the challenges confronting city governments across the country.

But there’s a vital piece of information omitted from that sentence: “problems that are essentially more extreme versions of the challenges confronting city governments across the country run by the Democratic Party.” Though Republican cities are not immune to such problems, make no mistake that the very worst examples are cities run by the Democratic Party, most for a very long time (Detroit hasn’t had a Republican Mayor since 1962, Chicago since 1931), and most are in states with solid (if not overwhelming) Democratic Party majorities.

The failure of America’s bankrupt cities is a microcosm of the failure of the Blue model of big government liberalism. And the reason I have spent so much time on covering California and Greece is that they are part of the same story: The failure of American liberalism is a microcosm of the bankruptcy of the welfare state, and the bankruptcy of the welfare state is a subset of the failure of socialism.

The quandaries begin with Chicago’s dramatic social divide. To an even greater extent than is the case in, say, New York or Philadelphia, Chicago has become two entirely separate cities. One is a bustling metropolis that includes the Loop, Michigan Avenue’s Magnificent Mile, and the Gold Coast, as well as the city’s well-to-do, working-class, and upwardly mobile immigrant neighborhoods. The other Chicago consists of impoverished neighborhoods on the far South and West Sides, primarily populated by African-Americans. These places have remained beyond the reach of the city’s recovery from the Great Recession.

As we have known since Charles Murray’s Losing Ground in 1984, welfare programs don’t lift the poor out of poverty, but keep them ensnared in it. Indeed, a cynic might observe that welfare programs are designed to create a voting clientele for the welfare state and the liberal party that runs it.

The problem, as Mark Steyn put it, is that “the 20th century Bismarckian welfare state has run out of people to stick it to. In America, the feckless insatiable boobs in Washington, Sacramento, Albany and elsewhere are screwing over our kids and grandkids. In Europe, they’ve reached the next stage in social democratic evolution: There are no kids or grandkids to screw over.”

As Steyn further noted:

A government big enough to give you everything you want isn’t big enough to get you to give any of it back. That’s the point Greece is at. Its socialist government has been forced into supporting a package of austerity measures. The Greek people’s response is: Nuts to that. Public sector workers have succeeded in redefining time itself: Every year, they receive 14 monthly payments. You do the math. And for about seven months’ work – for many of them the workday ends at 2:30 p.m. When they retire, they get 14 monthly pension payments. In other words: Economic reality is not my problem. I want my benefits. And, if it bankrupts the entire state a generation from now, who cares as long as they keep the checks coming until I croak?

The story of Detroit’s current bankruptcy is the story of Chicago’s coming bankruptcy, and the similar problems of California. All are dealing with bloated public sector pensions that are making their cities insolvent. All promised and spent money they didn’t have against their decedents, not realizing (or not caring) that the debt burden will ruin the worlds of those decedents before they could ever pay it off.

The theme with all is that deficit spending destroys, and the only cure is to force governments to pare back the welfare state and stop spending money they don’t have. As the example of Greece shows, there reaches a point in welfare state dependency at which actually curtailing welfare state spending, even at the point of financial ruin, is politically impossible. The looting of the public treasury cannot be stopped because that looting is the only thing that holds left-wing coalitions in power anymore.

One of the many reasons the Tea Party exists is to hold American politician’s collective feet to the fire to make sure the terminal phase of the welfare state Greece is now enjoying never gets that bad in America. (To this end, they’ve had the tiniest little glimmer of success.)

Chicago is Detroit is California is Greece is, eventually, America. It’s all part of the same story, and one any voting public ignores at its peril.

(Hat tip: Instapundit.)

Tags:bankruptcy, Budget, California, Chicago, Democrats, Greece, John B. Judis, pension crisis, unions, Welfare State

Posted in Budget, Democrats, unions, Welfare State | No Comments »

Thursday, April 2nd, 2015

Time for another Texas vs. California roundup. The Texas House passed a budget, but I haven’t had a chance to look at it in any detail yet…

Unemployment rates in February: National average is 5.5%, Texas at 4.3%, California at 6.7%.

Even though hiring slowed to 7,100 new jobs in Texas in February, it was still the 53rd straight month of positive job creation, and Texas added 357,300 new jobs over the preceding 12 months.

A report from the Dallas Fed goes into more details.

California institutes mandatory water restrictions due to drought. California is indeed suffering a horrific drought, but it’s imposition of or acquiescence to idiotic environmental restrictions (see also: Delta Smelt) have made things much worse.

Some have proposed free market solutions to California’s water problems.

Workers comp abuse at LAPD/LAFD. (Hat tip: Pension Tsunami.)

Add Richmond, California to the list of cities that have radically underfunded their public employee retirement plans. “The shortfall of $446 million works out to about $4,150 for every city resident.” (Ditto.)

San Bernardino reveals its bankruptcy deal with CalPERS. (Hat tip: Pension Tsunami.)

Volokh the Younger examines the legal framework around the California rule (“not only that public employees are entitled to the pension they’ve accrued by their work so far, but also that they’re entitled to keep earning a pension (as long they continue in their job) according to rules that are at least as generous”), as well as its practical effects:

The California rule distorts what the salary/pension mix would otherwise be, given employer and employee preferences, and given the tax code as it is. Because underfunded pensions are a popular form of deficit spending, public employee compensation may already be too pension-heavy, and the rule makes it more so by freezing pensions in times of retrenchment. The incentive effects of the rule, given the political economy of government employment, may well exacerbate this tendency. And the possible theoretical reasons for preferring a pension-heavy mix don’t go very far in justifying this particular distortion.

California runs out of room on death row. Maybe they could subcontract to Texas…

Fresno’s deputy police chief busted on drug charges.

Tags:Alexander Volokh, California, Fresno, LAFD, LAPD, Los Angeles, pension crisis, Richmond (California), San Bernardino, Texas, unemployment, unions, Welfare State

Posted in Texas, unions, Welfare State | No Comments »

Thursday, March 26th, 2015

Time for another Texas vs. California roundup:

Forget all those snide liberal cracks about Texas’ public education system, since we have some of the highest graduation rates in the country.

“San Bernardino has defaulted on nearly $10 million in payments on its privately placed pension bond debt since it declared bankruptcy in 2012.”

The missed payments illustrate the trend among cities in bankruptcy to favor payments to pension funds over bondholder obligations, which has increased the hostility between creditors and municipalities.

San Bernardino declared last year that it intends under its bankruptcy exit plan to fully pay Calpers, its biggest creditor and America’s largest public pension fund with assets of $300 billion.

The city continues to pay its monthly dues to Calpers in full, but has paid nothing to its bondholders for nearly three years, according to the interest payment schedule on roughly $50 million of pension obligation bonds issued by San Bernardino in 2005.

If you’re a bank, a retirement fund, or a hedge fund, why on earth would you buy California municipal debt when there are safer alternatives? (Hat tip: Ace of Spades HQ Doom roundup.)

So how’s that San Francisco minimum wage law working out? Exactly like everyone who understands economics expected. “Some restaurants and grocery stores in Oakland’s Chinatown have closed after the city’s minimum wage was raised. Other small businesses there are not sure they are going to survive, since many depend on a thin profit margin and a high volume of sales.” Plus this: “Low-income minorities are often hardest hit by the unemployment that follows in the wake of minimum wage laws. The last year when the black unemployment rate was lower than the white unemployment rate was 1930, the last year before there was a federal minimum wage law.”

California’s Legislative Analyst’s Office suggests phasing out state health care for workers entirely.

California is dead last in spending transparency among the 50 states, with an F rating and a piddling score of 34. Texas ranks 13th with an A- and a score of 91. (Hat tip: Cal Watchdog.)

“North Texas gained an average of 360 net people per day from July 2013 to July 2014, a testament to the job-creating machine in the Lone Star state, according to the U.S. Census Bureau…North Texas and Houston were the only metropolitan areas to add more than 100,000 people during that one-year period.”

Just because California has some of the highest taxes in the nation doesn’t mean that the state’s Democratic legislature doesn’t want to add still more.

Meanwhile, the Texas Senate just passed a $4.6 billion tax cut.

California is rolling out more subsidies for Hollywood.

The Los Angeles Department of Water and Power not only has the highest employe costs in the country, it also ranks last in customer satisfaction. (Hat tip: Pension Tsunami.)

While Texas is certainly in much better shape than California on public employee pensions, things here are not entirely cloudless either. “The Texas Employee Retirement System is reporting unfunded liability of $14.5 billion in 2014, compared with liability of just $6.3 billion in 2013. By comparison, all of the state government’s general obligation debt as of 2013 was $15.3 billion. The Texas Law Enforcement and Custodial Officer Supplemental Retirement Plan is reporting unfunded liability of $673.1 million in 2014, compared with $306.7 million in 2013.”

Unlike California, Texas looks to get ahead of the curve on pension concerns with House Bill 2608, which restores control of pension funds to the local level by eliminating legislative approval for pension changes. I”nstead of locking up significant benefits in state statute, HB 2608 would allow city pension systems, like the Houston Firefighters’ Relief & Retirement Fund, to solve pension problems at the local level by changing benefit structures, if they so chose.”

“Support for the “bullet train” is ebbing across California, except, perhaps, in the Governor’s mansion.”

California raisin packer West Coast Growers files for Chapter 11.

American Spectrum Realty, a real estate investment management company that operates self-storage facilities under the 1st American Storage brand, has somehow managed to file for bankruptcy in both California and Texas. I think it’s safe to say that financial shenanigans are involved…

Lawsuit over misappropriated funds in a Napa Valley winery leads to a murder/suicide. It’s one of those stories that sounds too strange not to link to…

Tags:Budget, California, Crime, Economics, education, Los Angeles, minimum wage, Napa, Oakland, pension crisis, San Bernardino, San Francisco, Texas, unions, Welfare State

Posted in Budget, Crime, Democrats, Economics, Texas, unions, Welfare State | No Comments »

Thursday, February 19th, 2015

Time for another Texas vs. California roundup:

U.S. bankruptcy judge presiding over the Stockton case says pensions are not sacred and can be cut in bankruptcy. “CalPERS has bullied its way about in this case with an iron fist insisting that it and the municipal pensions it services are inviolable. The bully may have an iron fist, but it also turns out to have a glass jaw.”

Public employee pensions: Stealing from the young and poor to give to the old and rich. (Hat tip: Pension Tsunami.)

California’s entrepreneurs still think the business climate sucks. “In the 2014 survey, 63.5 percent called the small business climate poor, with just 10 saying it’s good. This year 60 percent still consider the business climate poor with 16.5 percent finding it good.”

By contrast, low oil prices won’t torpedo Texas’ economy. “Texas’ economy today is more resilient to oil price fluctuations thanks to industrial diversification and pro-growth policies.”

California’s combined capital gains tax rate is the third highest. Not third highest in the U.S., third highest in the world, lower only than Denmark and France.

How environmentalists made California’s drought worse.

Two unions are on different sides of a proposed sale of six struggling Catholic hospitals to a private company.

Defense contractor “Advantage SCI, LLC announced today that the company will relocate its headquarters to Alexandria, Virginia (Fairfax County in Old Town Alexandria) from El Segundo, California, after recognizing the high costs related to worker’s compensation, liability, and taxes that plague businesses in California.”

Coffee roaster Farmers Brothers is leaving California for either Oklahoma or Texas.

More on the Farmer Brothers relocation. “After surviving depressions, recessions, earthquakes and wars, Farmer Brothers is leaving California, finally driven out by high taxes and oppressive regulations.”

California Democrats file bills to force the state to get 50% of its energy from renewable energy by 2030. They’re basically putting up yet another big red sign to manufacturers: “We’ll make it impossibly expensive for you to do business here.”

Why health care in California is less affordable than elsewhere.

The mess that is California’s homeowner earthquake insurance.

California property owners aren’t wild about being forced to sell their land for the high speed rail boondoggle.

Arlene Wohlgemuth on why Texas should avoid the siren song of Medicare expansion. (Also, best wishes to her for a speedy recovery from her motorcycle accident.)

California’s top lifeguard pulls in a cool $236,859 in total compensation. (Hat tip: Pension Tsunami.)

“Lewd yoga dentist filed for bankruptcy.” A San Diego dentist, which is my pretext for including it here, but really, how could I not link a headline like that?

Tags:Arlene Wohlgemuth, California, CalPERs, Democrats, Energy Policy, environmentalism, health care, high speed rail, oil industry, pension crisis, Regulation, Texas, unions, Welfare State

Posted in Democrats, Regulation, Texas, unions, Waste and Fraud, Welfare State | 1 Comment »

Thursday, January 29th, 2015

To a certain extent, this Texas vs. California roundup is incomplete, since we’re hot and heavy into the new legislative session and I haven’t had a chance to fully digest the proposed budget numbers yet. By the Legislative Budget Boards numbers, they’re only projecting a 1.5% increase in the 2016-2017 biennium budget over 2014-2015. But see the first link…

Setting the story straight on the Texas budget. TPPF uses a different baseline…

California’s public employee unions would prefer that you not know how well they’re compensated.

How California’s public employees use sick leave to spike their pensions.

Supreme Court may take on California union mandatory dues case.

Though not nearly as bad as California, Texas state and local public employee pensions are also in need of reform.

California’s Kern County declares a fiscal emergency over dropping oil prices. “Collapsing crude prices are squeezing the finances of Kern County, home to three-fourths of California’s oil production.” Thankfully, oil and gas extraction is a lot more widespread in Texas.

The City of Sacramento’s unfunded liabilities have reached $2.3 billion. (Hat tip: Pension Tsunami.)

“Fresno? No one goes to Fresno anymore!” Except for job growth percentage, that is, where Fresno outpaced Silicon Valley.

Remember the Newport Beach police department firing a whistler-blower? Via Dwight comes a followup: “A husband and wife who sued Newport Beach and its police department for alleged retaliation and wrongful termination have settled their lawsuits for $500,000, according to city officials.”

“Physician-assisted suicide has returned to California’s political agenda.” Well, why not? California’s ruling Democrats have been attempting fiscal suicide for well over a decade now…

Toyota breaks ground on its new Texas headquarters.

A public school in California is having a Hijab Day.

Tags:Budget, California, Democrats, Fresno, Jihad, Kern County (CA), Legislative Budget Board, Newport Beach, oil industry, pension crisis, Sacramento, Texas, Texas Public Policy Foundation, Toyota, unions, Welfare State

Posted in Budget, Democrats, Jihad, Supreme Court, Texas, unions, Welfare State | No Comments »

Wednesday, January 21st, 2015

The working poor benefit from a lower cost of living in red states.

Five of the top ten U.S. cities in economic growth in 2014 were in Texas: Austin, Houston, Ft. Worth. Dallas and San Antonio. (There were also two in California: San Francisco and San Jose.)

The Texas Comptroller has released the Biennial Revenue Estimate 2016-2017, which estimates $113 billion in general revenue-related funds available. The report details also notes that “In the past six years, Texas created two-thirds of all net new jobs in the U.S.”

By contrast, with the California budget more or less temporarily balanced, Democrats want to start spending like drunken sailors with a stolen credit card again. Legislative analyst: You don’t want to do that.

The average CalPERS pension is up to five times comparable Social Security payouts.

Jerry Brown says he wants to tackle California’s pension crisis. Good luck with that. While Brown has occasionally been willing to buck his party, and may feel he has nothing to lose in his last term, there’s no reason to believe the Democrat-dominated state House and Senate share his sentiments. I predict a few cosmetic measures passing combined with a whole lot more can kicking until actual default looms. (Hat tip: Pension Tsunami.)

“Central Valley farmers say farming is doomed in their areas.” California’s water regulations are driving them out of business.

Stockton’s bankruptcy judge: screw secured debtors, we’ve got to start paying retirees.

Key figure in CalPERS pension fraud case apparently committed suicide. Hmmm…..

California’s Set Seal retail chain files for bankruptcy.

John G. Westine of California convicted of 26 counts of mail fraud in a phony Kentucky oil well scheme.

Bankruptcy lawyers gone wild!

Tags:bankruptcy, California, CalPERs, Crime, farming, John G. Westine, pension crisis, Stockton, Texas, unions, Welfare State

Posted in Budget, Crime, Democrats, Texas, unions, Welfare State | No Comments »