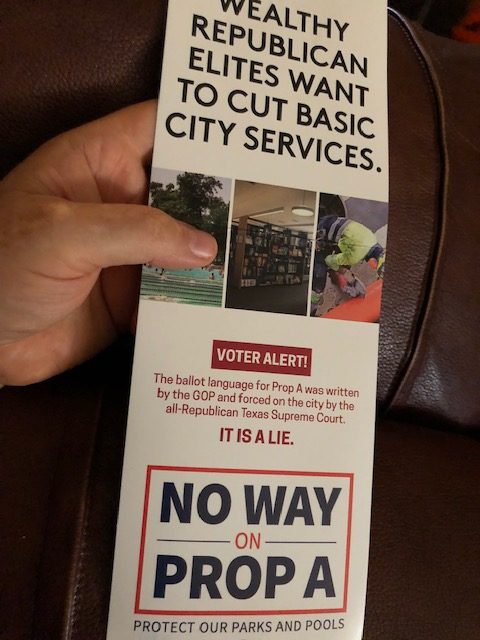

With plenty of out-of-state money (including half a million from George Soros), Austin Justice Coalition and their allies managed to deliver a resounding defeat to Proposition A. There was a lot of signage against Prop A, and readers in Austin say they received anti-Prop A flyers. Here’s an example:

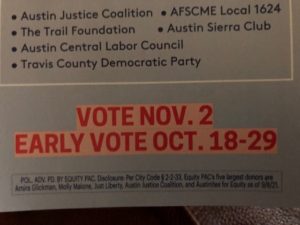

And here’s a closeup of who funded it:

There’s two places on the flyer it says it was partially funded by the Austin Justice Coalition.

Tiny problem: The Austin Justice Coalition is a 501(c)(3) organization last time I checked, and 501(c)(3) have very specific prohibitions against engaging in certain types of political activity and advertising.

(You might be wondering: Is that’s the case, how could SaveAustinNow legally campaign for Proposition A? Easy: They’re a 501(c)(4) organization, the rules for which are different.)

Did Austin Justice Coalition violate federal law? Maybe. Austin Justice Coalition briefly lost their tax exempt for failing to proper documentation. (It’s easier to search for information on them when you have their tax ID number: EIN 81-3138826.) But I’m not a lawyer, and the IRS statute language specifically mentions that 501(c)(3) organizations can’t campaign for or against candidates. I am unsure whether this prohibition extends to campaigning for or against ballot propositions.

Perhaps an expert in campaign finance law can shed some light on the issue…

(Hat tip: Blog commenter Clinton.)

Tags: 2021 Elections, 501(c)(3), Austin, Austin Justice Coalition, Democrats, IRS, Social Justice Warriors, Texas

Not a tax attorney. But a quick wade through the IRS website’s information on 501c3 regs comes up with this:

”A Section 501c3 organization may make a contribution to a ballot measure committee (a committee supporting or opposing ballot initiatives or referenda) but it must include such contributions in its lobbying calculations for purposes of determining wether s substantial part of its activities consist of attempting to influence legislation.

In general, no organization may qualify for sec. 501c3 status if a substantial part of its activities is attempting to influence legislation (commonly known as lobbying). A 501c3 organization may engage in some lobbying, but too much lobbying activity risks loss of tax-exempt status.”

Ultimately, I found the IRS’ description of what constitutes ‘legislation’, the influencing of which can be grounds for disqualification as a 501c3:

”Legislation includes action by Congress, any state legislature, any local council or similar governing body, with respect to acts, bills, resolutions… or by the public in referenda, ballot initiatives…etc.”

In short, a 501c3 May engage is some lobbying, but too much lobbying activity risks loss of tax-exempt status. The IRS website goes on to describe how ‘activity’ is measured both in funds and in the time spent by 501c3 paid and unpaid workers.

This may explain why AJC’s founder has been so negligent filing IRS form 990s— because it is that form that details a 501c3’s lobbying activities. Failing to file those forms suggests to me that Chas knows his AJC is violating IRS refs re: lobbying, but he at least has the sense not to file falsified reports and risk being charged with tax fraud.

BTW, Lawrence, I’ve emailed to you the IRS web pages I quoted above.

Attempting to provide a link to the relevant IRS webpage keeps getting thrown out, so I’ll include the address:

https://www.irs.gov/charities-non-profits/charitable-organizations/frequently-asked-questions-about-the-ban-on-political-campaign-intervention-by-501c3-organizations-contributions-to-ballot-measure-committees

Not a tax attorney, but the gist of the IRS’s stance seems to be that a 501c3 may engage in a little political activity, but there is some threshold beyond which the IRS deems the group in question is no longer primarily charitable, but has become political.

That determination would be based on the organization’s Form 990 reports, which record political contributions of both money and manpower. Those are the same reports AJC’s founder has already repeatedly neglected to file…

Fixed the link.