And here’s another Friday LinkSwarm!

Posts Tagged ‘Eurozone’

LinkSwarm for May 17, 2013

Friday, May 17th, 2013David Cameron Suddenly Remembers He’s a Tory

Wednesday, January 23rd, 2013Well well well, maybe David Cameron has some cobbles after all.

Cameron has generally presided over the “wettest” Tory administration the UK has seen since Neville Chamberlain, but today he delivered a veritable pipe bomb of a speech on the future of the European Union.

First, the problems in the Eurozone are driving fundamental change in Europe. Second, there is a crisis of European competitiveness, as other nations across the world soar ahead. And third, there is a gap between the EU and its citizens which has grown dramatically in recent years. And which represents a lack of democratic accountability and consent that is – yes – felt particularly acutely in Britain.

Also this:

If Europe today accounts for just over 7 per cent of the world’s population, produces around 25 per cent of global GDP and has to finance 50 per cent of global social spending, then it’s obvious that it will have to work very hard to maintain its prosperity and way of life.

While Obama is certainly doing his best to make sure America’s portion of that last figure increases (driving down Europe’s share as a side effect), what Cameron is saying here is both obviously true and absolutely unacceptable to the Euroelite: The European cradle-to-grave welfare state is unsustainable.

And this:

People are increasingly frustrated that decisions taken further and further away from them mean their living standards are slashed through enforced austerity or their taxes are used to bail out governments on the other side of the continent.

Cameron basically stood up and pointed out that the Emperor has no clothes.

Still more:

More of the same will not secure a long-term future for the Eurozone. More of the same will not see the European Union keeping pace with the new powerhouse economies. More of the same will not bring the European Union any closer to its citizens. More of the same will just produce more of the same – less competitiveness, less growth, fewer jobs.

“Hey dumbasses: stop digging!!”

And still more:

I want us to be at the forefront of transformative trade deals with the US, Japan and India as part of the drive towards global free trade. And I want us to be pushing to exempt Europe’s smallest entrepreneurial companies from more EU Directives.

These should be the tasks that get European officials up in the morning – and keep them working late into the night. And so we urgently need to address the sclerotic, ineffective decision making that is holding us back.

That means creating a leaner, less bureaucratic Union, relentlessly focused on helping its member countries to compete.

In a global race, can we really justify the huge number of expensive peripheral European institutions?

Can we justify a Commission that gets ever larger?

Can we carry on with an organisation that has a multi-billion pound budget but not enough focus on controlling spending and shutting down programmes that haven’t worked?

And I would ask: when the competitiveness of the Single Market is so important, why is there an environment council, a transport council, an education council but not a single market council?

And here we have a Tory Prime Minister actually sounding like…a Tory! Who would have thunk it?

Thatcher or Reagan he’s not, but this is bold stuff given the Eurocentric tenor of post-Thatcher UK governments.

Oh: He also wants a referendum on EU membership by 2017.

Reactions from the Eurocratic elite has been predictable: How dare Cameron slander our magnificently robed Emperor? And naturally all of them focus on the referendum than his substantive critique of the increasing collectivist, bureaucratic and unsustainable EU.

Good show, Cameron old boy, good show. (Golf clap)

EuroDoom Weekend Update

Saturday, May 19th, 2012Good evening. I’m not Chevy Chase, and you’re not either. (Unless the real Chevy Chase is reading this, in which case: 1. Loved you on the original SNL, and 2. Stop being such a total dick.)

The EuroZone crises has now reached the stage where European media is doing live updates.

Take a look at this update: “German Chancellor Angela Merkel has mooted the idea that Greece should hold a referendum on the euro alongside its second round of elections next month.” Well, no use even pretending that the Greeks have a say in their own future, is there?

The Zuckermutterobergroupenführer has spoken!

In other EuroDoom news:

A Folly for the Ages

Wednesday, May 9th, 2012Over on Big Journalism, Joel Pollack makes a point I’ve been emphasizing in my EuroDoom roundups: Austerity hasn’t failed in Europe, it hasn’t even been tried:

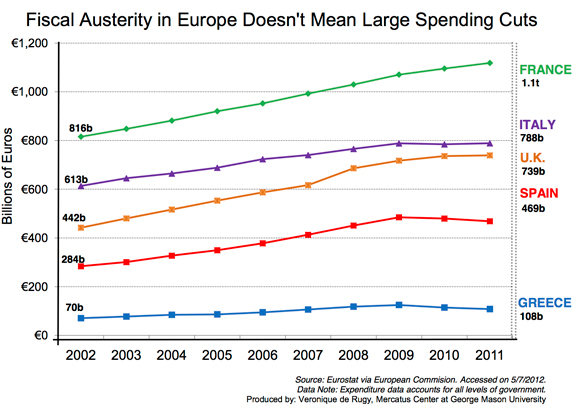

The media insists on describing recent election results in Europe as a blow to “austerity,” when in fact Europe’s recent policies are anything but. Government spending has continued to rise across much of Europe, and even those countries that have made small cuts have not reduced government spending to pre-recession levels.

He in turn references this Veronique de Rugy piece at NRO (though the link is broken, so I had to go Googling) which also gives us this handy chart:

None of these “austerity” measures eliminated deficit spending, and none addressed the issue that’s driving all of Europe (and us) bankrupt, namely unwillingness to carry out structural reforms of the welfare state. The few tiny reforms that have been undertaken have been, as NRO’s Michael Tanner notes, ridiculously timid, and even those have been heavily weighted in future years. “So far, European governments haven’t even been willing to take a penknife to the welfare state, let alone an axe.” Plus a huge round of tax hikes:

It should come as no surprise that all those new taxes, combined with a lack of spending restraint, has threatened to throw Europe back into a double-dip recession. Is it any wonder that French, Greek, and British voters were anxious to “throw the bums out”?

Wait, this sounds familiar. Tax hikes on the rich accompanied by vague promises of future spending restraint, while refusing to restructure entitlement programs. That sounds a lot like . . . Barack Obama.

Actual austerity would mean (at a minimum) reducing spending to the amount of money actually taken in. As best I can tell, none of the PIIGS, or France, or the UK has undertaken such real austerity. That “severe” Greek austerity that just caused a change in government? It reduced Greece’s official deficit spending from 9.0% of GDP to 7.5% of GDP. They didn’t even want Greece to stop digging a hole, they just wanted them to dig more slowly.

I suspect that some 20-30 years hence, this mania for deficit spending will be seen as absolute madness, with future generations unable to fathom how politicians were so resolute in destroying their countries economies in order to maintain the welfare state, a folly for the ages. Hyperinflation is probably already baked into the Greek pie for its inevitable exit from the Eurozone, the only question is whether it will be Argentina 1999-2002 style hyperinflation, or Weimer Germany 1919-1923 style hyprinflation, and how much of Europe (and the rest of the world) will follow in their tracks.