Dallas Police and Fire pension fund are near insolvency thanks to shady real estate deals:

The Dallas Police & Fire Pension (DPFP), which covers nearly 10,000 police and firefighters, is on the verge of collapse as its board and the City of Dallas struggle to pitch benefit cuts to save the plan from complete failure. According the the National Real Estate Investor, DPFP was once applauded for it’s “diverse investment portfolio” but turns out it may have all been a fraud as the pension’s former real estate investment manager, CDK Realy Advisors, was raided by the FBI in April 2016 and the fund was subsequently forced to mark down their entire real estate book by 32%. Guess it’s pretty easy to generate good returns if you manage a book of illiquid assets that can be marked at your “discretion”.

To provide a little background, per the Dallas Morning News, Richard Tettamant served as the DPFP’s administrator for a couple of decades right up until he was forced out in June 2014. Starting in 2005, Tettamant oversaw a plan to “diversify” the pension into “hard assets” and away from the “risky” stock market…because there’s no risk if you don’t have to mark your book every day. By the time the “diversification” was complete, Tettamant had invested half of the DPFP’s assets in, effectively, the housing bubble. Investments included a $200mm luxury apartment building in Dallas, luxury Hawaiian homes, a tract of undeveloped land in the Arizona desert, Uruguayan timber, the American Idol production company and a resort in Napa.

Despite huge exposure to bubbly 2005/2006 vintage real estate investments, DPFP assets “performed” remarkably well throughout the “great recession.” But as it turns out, Tettamant’s “performance” was only as good as the illiquidity of his investments. We guess returns are easier to come by when you invest your whole book in illiquid, private assets and have “discretion” over how they’re valued.

In 2015, after Tettamant’s ouster, $600mm of DPFP real estate assets were transferred to new managers away from the fund’s prior real estate manager, CDK Realty Advisors. Turns out the new managers were not “comfortable” with CDK’s asset valuations and the mark downs started. According to the Dallas Morning News, one such questionable real estate investment involved a piece of undeveloped land in the Arizona desert near Tucson which was purchased for $27mm in 2006 and subsequently sold in 2014 for $7.5mm.

It gets better: “Then the plot thickened when, in April 2016, according the Dallas Morning News, FBI raided the offices of the pension’s former investment manager, CDK Realty Advisors.”

Also: “And of course the typical pension ponzi, whereby in order to stay afloat the plan is paying out $2.11 for every $1.00 it collects from members and the City of Dallas effectively borrowing from assets reserved to cover future liabilities (which are likely impaired) to cover current claims in full.”

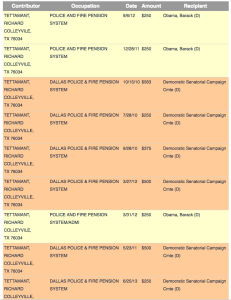

Want to guess which political party Richard Tettamant was affiliated with?

Go ahead. Guess.

(Hat tip: Jack Dean of Pension Tsunami.)