I hope you survived Independence Day will all your digits intact! Slow Joe’s poll numbers plumb new depths, everyone knows the media is complicit in hiding his mental decline, Israel settles all family business, Rishi’s snap election is a debacle for the Tories, Wall Street looks to get the hell out of the Rotten Apple, and California legalizing weed was a big win…for illegal weed. It’s the Friday LinkSwarm!

Oh, and parts of south Texas might get hit with a hurricane. So batten up and get prepped if it might roll into your neighborhood. Up here, we can use the rain. And that crazy guy trying to build a forest in the desert can probably use it too.

Voters that say Biden has the mental health to be President: It was only 35% pre-debate, look where it’s dropped to now post-debate, 27%.

How ’bout that he should be running for President? It’s 37% pre-debate, it’s now 28%…

I have never seen numbers this bad for an incumbent president during my lifetime … These numbers looked NOTHING like this in 2020. These numbers were bad already … they have gotten considerably worse even in just a few days after that first presidential debate.

As in “Biden is winning Illinois…by three points” bad. New York is within striking distance for Trump. And right now he’s even edging Biden in New Jersey. (Hat tip: Ace of Spades HQ.)

According to ‘several people familiar with his remarks,’ and perhaps most notably conveyed via the Washington Post, not only has Obama grown more concerned following the debate (and having to physically guide the 81-year-old off of a stage last month), the former president “has long harbored worries about his party defeating Donald Trump in November, repeatedly warning Biden in recent months about how challenging it will be to win reelection.”

Not only that, “Just before the debate, Obama conveyed to allies his concerns about the state of the race.”

So Obama gets to save face, while adding to the growing chorus of Democrats who have expressed everything from quiet panic to public hints, to outright calls for Biden to drop out of the race.

Usual “sources close to” caveats apply.

If you’re looking for a broader takeaway from all this, take how the press covered up Biden’s infirmity because it wanted to protect the Democrats, and apply it to literally every single thing that it does, on any topic, in any year, in any circumstance, forever.

— Charles C. W. Cooke (@charlescwcooke) July 3, 2024

Now that all the liberal journalists are claiming they didn't try to cover up Biden's deteriorating mental condition, here's a supercut of them claiming any and all damaging videos of Biden are fake and/or deceptively edited. pic.twitter.com/XI5zeTGih5

— Nicholas Fondacaro (@NickFondacaro) July 3, 2024

(Hat tip: Ace of Spades HQ.)

Epic video from @TheHoleTweet

— Juanita Broaddrick (@atensnut) July 2, 2024

Democrats decided to shut Joe Biden down for a week. Not because they wanted to, but because they figured they had to. It was the only chance Biden had — thin as it turned out to be — to get through a 90-minute session in which he’d be asked questions he couldn’t answer with note cards, in which he’d be challenged vigorously and need to be quick on his shuffling feet.

Here’s the thing, though. What we saw on Thursday night was the result of that week of preparation and rest. And it was a disaster. So . . . what must the prep have been like?

Biden’s closest aides and the top Democrats with whom they are in constant communication know better than anyone in America that the president cannot function, that he cannot do the job. Yet, rather than ease Biden out, invoke the 25th Amendment if he wouldn’t go voluntarily, and ensconce in the Oval Office the vice president they insisted in 2020 would be ready to take over if the octogenarian collapsed, they decided they had to try to drag Biden across the finish line.

Why?

Because the Democratic Party is a trainwreck.

As catastrophic as Biden is in his senescence, he remains useful cover for the fact that the youth, energy, and money in the Democratic Party is woke-leftist, Islamist, counter-constitutionalist, post-American, and unelectable.

This doesn’t mean the whole Democratic Party is that way. But it does mean that sensible Democrats have to mind their tongues and genuflect in the crazies’ direction if they want to remain viable. They may personally believe, like the majority of Americans believe, that the border needs to be secure; that we can’t allow millions of illegal aliens a year to enter the country; that we don’t want boys and men invading the formerly safe spaces of girls and women; that mere statistical racial disparities in outcomes do not establish racism; that crime — especially recidivist crime — is a serious problem; that we need to back Israel’s wars against Hamas, Hezbollah, and their Iranian patrons; that a radical “green energy” transition the country is not ready for weighs too heavily on the budgets of everyday Americans even as it drives the national economy deeper into the ditch; and that America, warts and all, is fundamentally good — rightly, the envy of the world. But woe betide the Democrat who gives voice to such commonsense views.

Democrats have thus rolled the dice with Biden, and with the nation’s security, because the alternative is dealing with that rift.

Joe Biden is a lifelong mediocrity. But he has the fortuity of being both a Democrat from another era and Obama’s vice president. Because he’s a doddering blank slate, Democrats of all camps could project onto him their kind of Democrat. He could run in 2020 as the guy who could face down the radicals, and then govern under the thumb of the radicals — but with enough rhetorical feints to the old establishment Dems that they might yet rally around him . . . especially with no alternatives except the hard left and Donald Trump.

Why Joe Biden? Because Democrats want to stay in power and propping him up, as impossible as that has now become, seemed to be the best plan. Sadly, it may yet be.

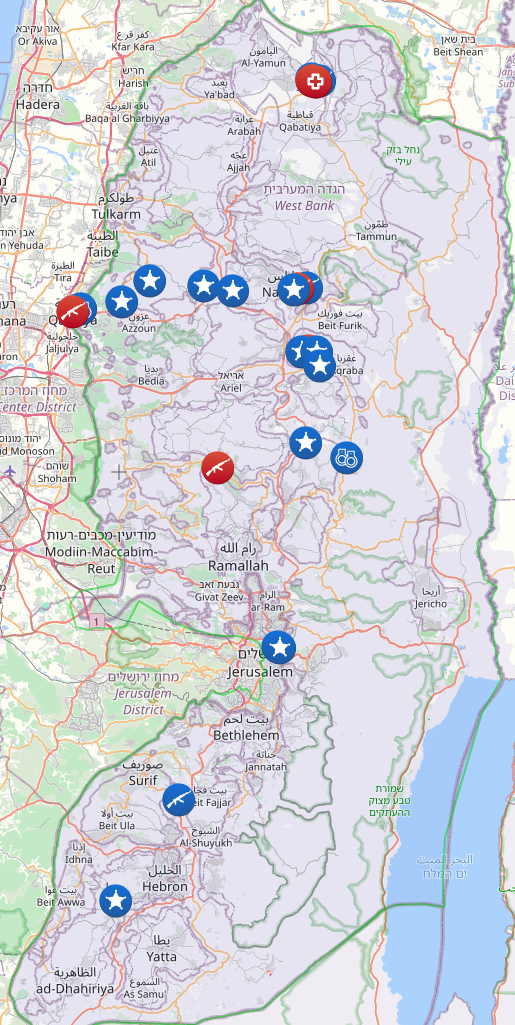

Israel may be in a “settle all family business” sort of mood…

Six years after California legalized marijuana, the bodies keep piling up. Earlier this year, six men were murdered in the Mojave Desert. Four of the men had been burned after being shot with rifles. In 2020, seven people were killed at an illegal pot operation in Riverside County.

Violence like this was supposed to disappear after legalization. Legalization advocates argued that making the drug trade legal would end the grip of the cartels. Instead, the legal market has failed, and the cartels are taking over sizable parts of California and the rest of the country.

California’s legal drug revenues have fallen consistently, as have those in other legal drug states including Colorado, whose model helped sell the idea that drug money would fix everything.

Despite falling revenues, Colorado legislators brag about $282 million in drug revenue. That number may sound high, but it’s a drop in the bucket considering the money that the state and cities like Denver are spending on homelessness, drug overdoses and law enforcement.

While the legal drug business is also collapsing in California, the state is spending a fortune fighting marijuana even as it tries to tax it. Gov. Gavin Newsom paradoxically promised to close the budget deficit with $100 million in drug revenue, meant to be used to fund law enforcement and fight substance abuse. The state seized over $300 million in illegal pot this year and uses satellite imagery and heavily-armed raids to fight untaxed marijuana.

But despite all those efforts, illegal marijuana has won and legal marijuana has lost.

The Los Angeles Times warned two years ago:

“Proposition 64, California’s 2016 landmark cannabis initiative, sold voters on the promise a legal market would cripple the drug’s outlaw trade, with its associated violence and environmental wreckage.

“Instead, a Los Angeles Times investigation finds, the law triggered a surge in illegal cannabis on a scale California has never before witnessed.

“Rogue cultivation centers like Mount Shasta Vista now engulf rural communities scattered across the state, as far afield as the Mojave Desert, the steep mountains on the North Coast, and the high desert and timberlands of the Sierra Nevada.

“Residents in these places describe living in fear next to heavily armed camps…”

Some of the growers are private citizens, but they aren’t likely to remain in business for long.

Cartels and gang members dominate the business. And open borders allowed them to bring massive numbers of laborers to boost their ranks. Not only California, but places as far afield as Maine that have large open areas and limited law enforcement resources, have been overrun by drug operations that more closely resemble parts of Latin America and Asia than the USA.

The coasts, from Southern California up to Oregon, are controlled by Mexican cartels which have expanded so much that they’re running short of workers even during the Biden open borders boom. Some have taken to brazenly advertising for illegal workers in Europe.

A local California DA described “Mexican cartel groups coming up to grow pot, and people from Bulgaria, France and Russia.” The vast exodus across the border has made it possible for cartels to freely bring in any workers they want, even as drug legalization and open borders effectively ended any real penalties for either illegal migration or marijuana.

Asian organized crime may be less on the radar, but it is no less ruthless or violent.

A few years ago, four Chinese people were murdered at an Oklahoma illegal pot farm. Chinese organized crime had “taken over marijuana in Oklahoma and the United States,” the head of the Oklahoma Bureau of Narcotics and Dangerous Drugs revealed.

Once again, “the mafias set their sights on Oklahoma when the state’s voters approved a ballot measure that legalized the cultivation and sale of marijuana for medicinal purposes.” Now the Triads run their own compounds “ringed by fences, surveillance cameras and guards with guns and machetes” with 3,000 illegal grows having a value estimated at as high as $44 billion a year.

The Triads are not just in the illegal marijuana business, they traffic in everything from heroin to fentanyl. Legalizing marijuana, however, provided them with a profitable and semi-legal market that gives them a base to expand their efforts trafficking in even more lethal drugs.

Drug legalization has failed on every level. The legal drug business is collapsing. MedMen, which once promised to be the Apple of weed, fell from a $3 billion valuation to a bankruptcy with $411 million in liabilities. Despite the green crosses and online apps, 80% of Californian’s pot is still the old-fashioned illegal kind. Politicians may be boasting about hundreds of millions in revenue, but the cartels are making tens of billions and they’re taking over entire forests.

The future isn’t pot shops, weed apps or MedMen: it’s Mexican and Chinese organized crime compounds that are spreading across the West and parts of New England like a plague.

State Farm requested massive increases to its California residential insurance rates, which calls its financial stability into doubt amid an ongoing crisis in the state’s insurance market.

The company’s California subsidiary, State Farm General, the state’s largest writer of homeowners insurance, according to the Insurance Information Institute, submitted a request on Thursday to the California Department of Insurance for the following rate hikes:

- 30% increase in homeowners insurance

- 336% increase in condominium owners insurance

- 352% increase in renters insurance

With California’s property insurance market already facing an availability and affordability crisis, driven largely by rising wildfire risk, the timing could hardly be worse.

Gee, maybe you shouldn’t have legalized shoplifting in the name of “social justice.”

The Supreme Court of the United States (SCOTUS) has ruled unanimously in a case involving a 2021 Texas social media transparency law, sending it back to the U.S. 5th Circuit Court of Appeals.

House Bill (HB) 20, which requires major social media platforms to be more transparent and prohibit viewpoint-based censorship, passed in the 87th Legislature. It faced an immediate legal challenge, resulting in a temporary block by a federal district court. This decision was appealed to the 5th Circuit, which temporarily lifted the block, allowing the law to take effect.

Justice Elena Kagan delivered the opinion for SCOTUS, writing, “Texas has never been shy, and always been consistent, about its interest: The objective is to correct the mix of viewpoints that major platforms present. But a State may not interfere with private actors’ speech to advance its own vision of ideological balance.”

So the Supreme Court will not save Americans from big tech companies teaming up with secret government entities to impose censorship on their platforms. Americans will have to do that for themselves.

Best babysitter..

pic.twitter.com/t86rIsa7Gi

— Buitengebieden (@buitengebieden) June 30, 2024

What more could you ask for? (Hat tip: Ace of Spades HQ.)

Still between jobs, so hit the tip jar if you’re so inclined.

The hedge funds are LONG silver NOT short silver.

The hedge funds are LONG silver NOT short silver. Dragon Spanker

Dragon Spanker

(@JackPosobiec)

(@JackPosobiec)