Let me start out by explaining how cryptocurrency works: You exchange your money for digital strings of numbers based on math you don’t understand, for one of the following reasons:

A. You believe those digital strings of numbers will be worth more money at some point in the future.

B. You want to buy drugs online in a theoretically untraceable manner (said theoretical untraceability being a key property of the math you don’t understand).

C. You want to place your money beyond the reach of your national government.

There are exceptions to the above (say, you’re mining your own cryptocurrency, or you know enough math to understand exactly the mathematical properties of how blockchain-based cryptocurrency works), but I’m going to guess that one of the three above use cases apply to 95% people using cryptocurrency.

I’m somewhat sympathetic to C, and even understand how A might be tempting (hey, crypto has dropped so much I might buy a couple thousand worth of Dogecoin, just for the hell of it, as a pure speculation play), but cryptocurrencies as a whole are not a proven store of worth on par with, say, a bar of gold, a share Apple stock, or a

Is cryptocurrency money? Sort of.

Cryptocurrency offers something that sometimes acts like money, offers anonymity like money, and offers an alternative to government-backed fiat currencies. Instead of being backed by the full faith and credit of the federal government, cryptocurrency is backed by the full faith of millions of technologically savvy individuals who believe the math is sound.

The math may indeed be sound, but that didn’t save it from the loss of investor confidence of the Crypto Winter we’re now experiencing. And that winter is absolutely slamming the business models of people who sought to make crypto more like other forms of money.

Enter Sam Bankman-Fried and FTX, whose crypto empire just collapsed.

Here’s the 99 second summary.

I could talk about the FTX collapse for hours on end. But there's no time! Here's the whole awful glorious mess crammed into 99 seconds. #FTX #FTXCRASH #MelonHead pic.twitter.com/2lqq4rASu1

— Nobody Special (@JG_Nuke) November 11, 2022

Here’s the story in a bit more depth.

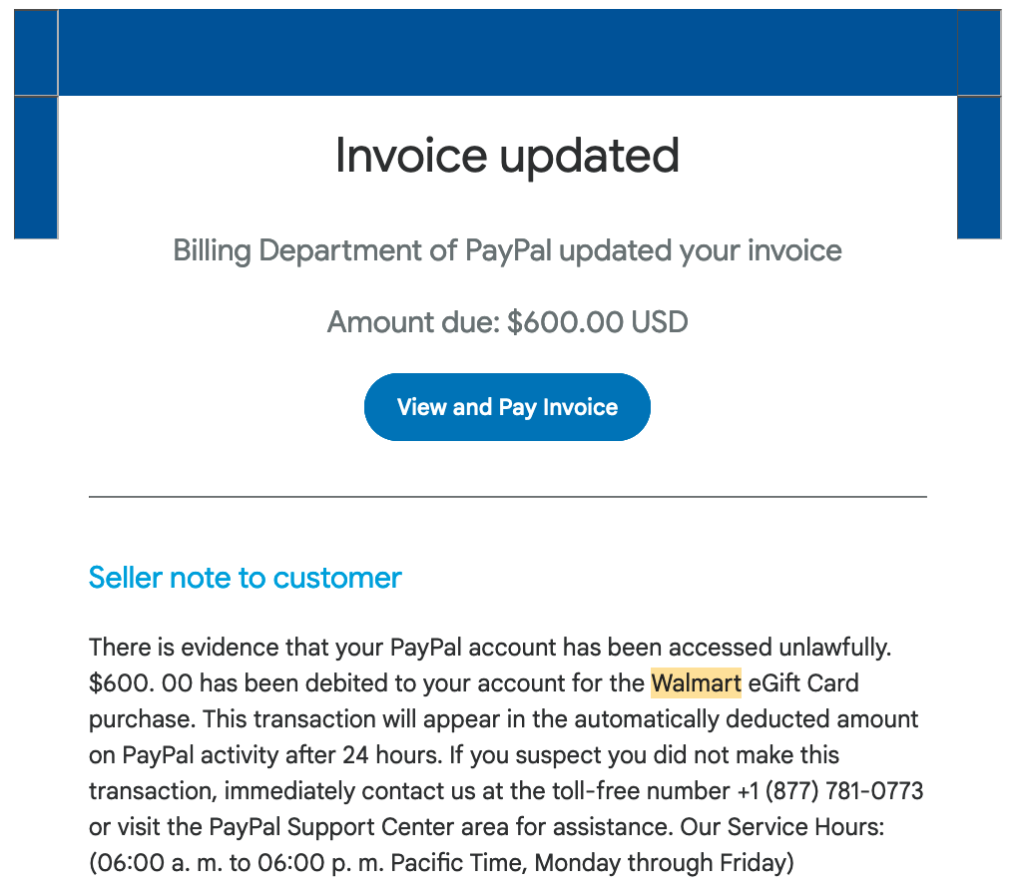

Amid all the jubilation and gloating by Joe Biden, Chuck Schumer and pals over the Democrats’ better-than-expected showing in the midterms comes a disturbing story that may explain something about how they won such a curious election.

Biden’s second-biggest donor, cryptocurrency billionaire wunderkind Sam Bankman-Fried, a k a SBF, saw his business file for bankruptcy days after the election, but not before pumping $40 million into the Democratic Party to spend on “get-out-the-vote” and other shadowy ballot-harvesting mechanics for the midterms.

The shambolic 30-year-old whiz kid, once said to have been worth $16 billion, had spent $10 million helping get Biden elected in 2020.

SBF’s mother, Stanford law professor Barbara Fried, also is co-founder of left-wing political action committee Mind The Gap, which has raised a reported $140 million to help Democrats win elections through the same “get-out-the-vote” grift.

Tree. Acorn. Distances.

A more unlikely billionaire you could not find — and of course his money was built on thin air. A math genius with poor social skills, SBF reportedly lived in a “polycule” — a polyamorous relationship with multiple people — in a luxury penthouse with about 10 co-workers in the tax haven of the Bahamas, where his collapsed crypto exchange FTX was headquartered.

Otherwise, he was sleeping on beanbags in his office, eating vegan fries and, according to his own Twitter feed, popping amphetamines and sleeping pills to regulate his chaotic sleeping habits.

Just the sort of person you want to entrust billions in currency to!

Now Reuters is reporting that between $1 billion and $2 billion of customer funds have vanished from FTX, conveniently after the Democrats safely spent his money.

At last report, SBF and his mysterious co-founder, Gary Wang, were being held “under supervision” by Bahamian authorities after reportedly planning to flee to Dubai, according to fintech publication Cointelegraph.

It is a stunning fall to earth. The financial media and big investors have feted the young billionaire as a saint who shunned earthly pleasures like Lamborghinis and Rolexes, but lived only to give away all his money and make the world a better place.

He was the most famous millennial adherent of a cult known as “Effective Altruism,” which originated at Oxford University, found fertile ground in Silicon Valley — and now has gone down in flames along with him.

“Indulgences! Buy your Social Justice Indulgences here!”

EA is a disguised form of socialism, because all the “good” that is done just happens to match up perfectly with the left’s obsessions, whether climate change, social justice, equity, banning meat or his favorite, “pandemic preparedness.”

In a Nas Daily online video, an awkward Bankman-Fried was featured this year as a role model of altruism for young people: “Sam is not a traditional billionaire because he believes in the concept of ‘earn to give’ … Next decade he will probably give away more than $10 million … He wants to get rich in order to impact the world and change it.”

Some detail snipped.

The sinister neo-socialists at the World Economic Forum (WEF) loved SBF so much, they made FTX a “corporate partner” — but that page on the WEF website has vanished in the last 48 hours, leaving an error message.

Venture capital firm Sequoia was a big backer, investing over $200 million in SBF, a lot of which he then invested back in Sequoia, whose chairman and managing partner Michael Moritz is a big donor to the Dems as well as to anti-Trump hate group the Lincoln Project, and reportedly is a neighbor of Nancy Pelosi in San Francisco.

It’s like a Voltran of Globalist Grift!

One important part the Post piece leaves out is how Alameda Research, Bankman-Fried’s other firm, was trading billions of dollars from FTX accounts and leveraging the exchange’s native token as collateral, according to a source.”

Embezzling, Ponzi scheme, security and exchange violations…it’s a rich, cross-hatched tapestry of fraud.

Here’s Joe Rogan on the Brokeman-Fraud scandal:

And here’s Ben Shapiro:

Every generation gets the Bernie Madoff it deserves…